Our services

Monitoring and evaluating property investment portfolios

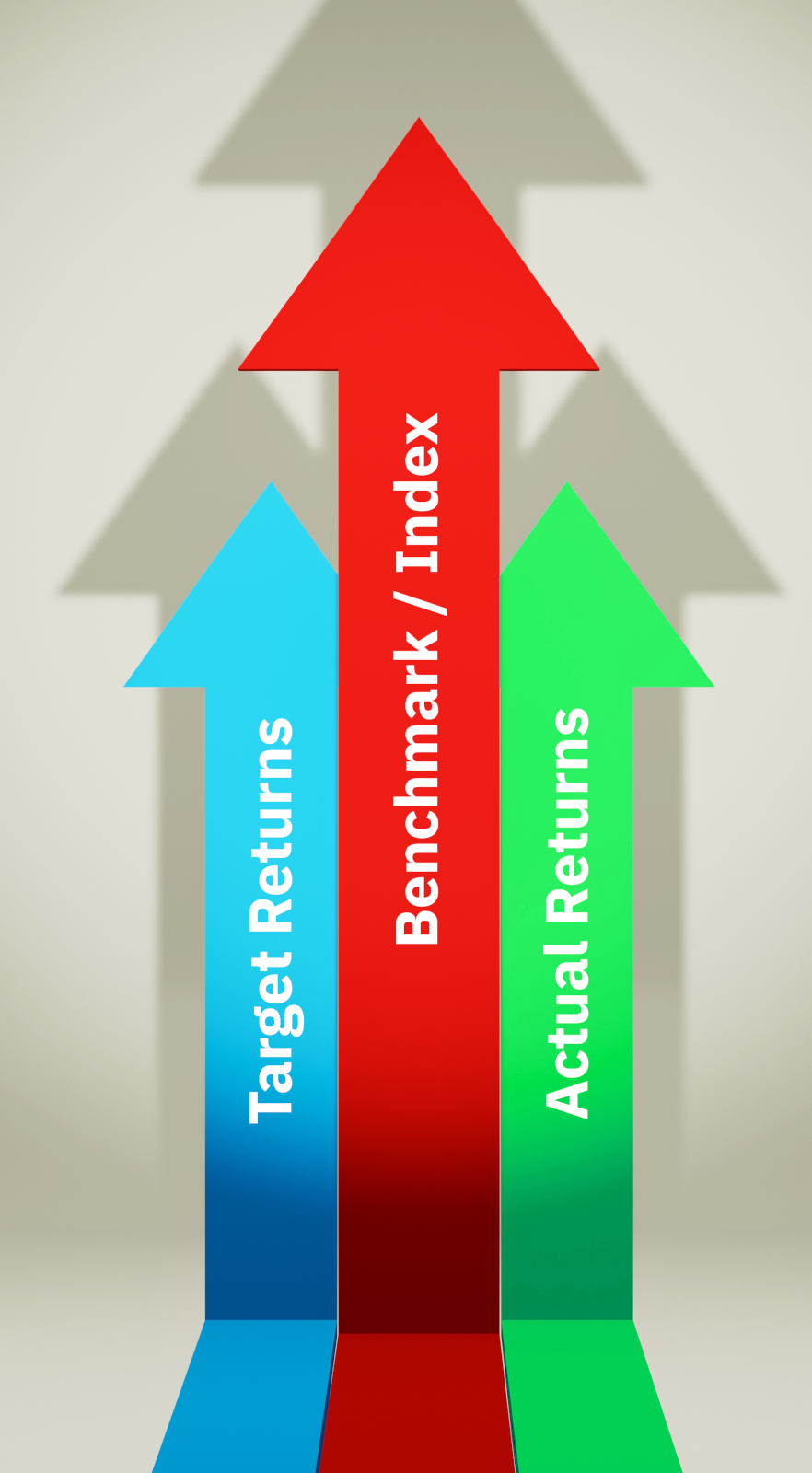

An optimal portfolio can possibly outmatch the performance of the selected benchmark or index.

Monitor Assets

Engage Portfolio Management

The value, returns and performance of an investment are immensely crucial parameters for investors to take decisions on throughout their investment journey; whereas, significance of these terms vary in the context of portfolio.

Investors are concerned with aggregated returns from individual assets exclusive of portfolio valuation fees, legal fees on abortive purchases and other fund management fees. Although these are nominal rates of return, investors whose liabilities are denominated in real terms seek real returns that account for impact of inflation. Furthermore, in cases where funds are borrowed to purchase assets, returns here are geared returns and systematically vary due to contingency on the movements in capital value and income flows.

Property investment performance indices and operating performance of investments in commercial and residential real estate are published by global and local institutions in regions where real estate activity is voluminous. Global Investment Performance Standards (GIPS) are voluntary standards utilized for presenting investment performance to investors which define certain criteria and conditions for portfolio valuations pertinent to real estate with ‘Fair Value’ being the basis of valuation.

“Fair Value is the amount at which an investment could be sold in an arm’s-length transaction between willing parties in an orderly transaction.”

The above definition may seem analogous to market value; however, this is principally expressed in terms of financial accounting standards with absence of information on the expected internal rate of return or prospective estimates that the current investors are anticipating.

Portfolio performance is measured by investors at systematic intervals to evaluate whether the fund has achieved its investment objectives. Total and market risks of the portfolio are analyzed to decide the level of diversification and whether the fund has under or outperformed the market (selected benchmark or index), and identify sub-segments or properties associated to the resultant performance for further review.