Our services

Strategic investment in real estate

The real estate market provides abundant opportunities with multitude of risk and return combinations where investors are obliged to strategize their approach.

Maximize Returns

Develop an Investment Strategy

Investors willing to invest in real estate are predominantly provided with direct and indirect real estate investment opportunities where both types of real estate investment possess its own complexity and risk. It is crucial for active or passive investors to properly document, evaluate, monitor and validate their real estate investment journey in order to ensure that their investments are aligned with their expectations and risk appetite.

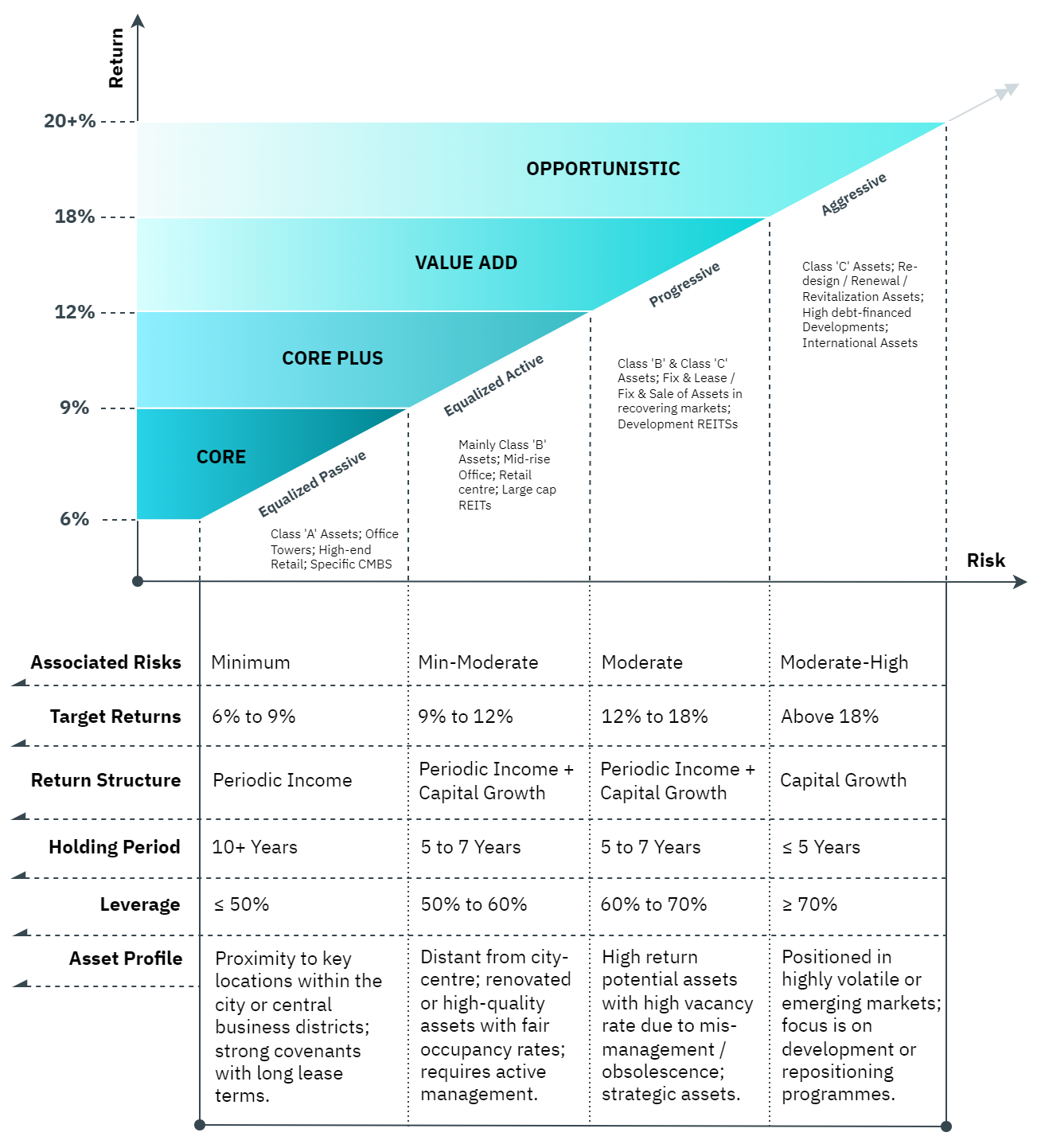

A classification system commonly used as the industry standard for categorizing different levels of risk-return profiles is illustrated in the figure below.

© REALTYGY

The risk-return profile spans across four distinct groups – ‘Core’, ‘Core Plus’, ‘Value Add’, and ‘Opportunistic. These groups are positioned along the spectrum in the order of risk associated to them and returns originating from security of income to growth oriented characteristics. Although returns from an investment through an investment strategy has varied geographically and periodically, hierarchy of the illustrated risk-return profiles has been consistent with slight variation on return rates across different regions.

It is indisputable that high risk opportunities that provide high returns are associated with complexity and uncertainty despite the special expertise involved in turning the investment profitable. Furthermore, such investments also comprise of increased financial risk due to high degrees of leverage and significant volatility of cash flows; hence, holding period is not the primary objective of progressive and aggressive investors here.

Apparently, majority of the real estate investments made by individual and institutional investors are concentrated in ‘Core’ and ‘Core Plus’ category. As a consequence, most investors are ‘risk averse’ and rarely seek ‘Value Add’ and ‘Opportunistic’ prospects for investment. Although every investor’s ambition is to attain maximum returns from their investments, it is evident that this is immensely contingent on the risk the investor is willing to manage and accept, inclusive of the investment strategy behind to make it favorable.