Our services

Value, returns and performance are crucial to investment decisions

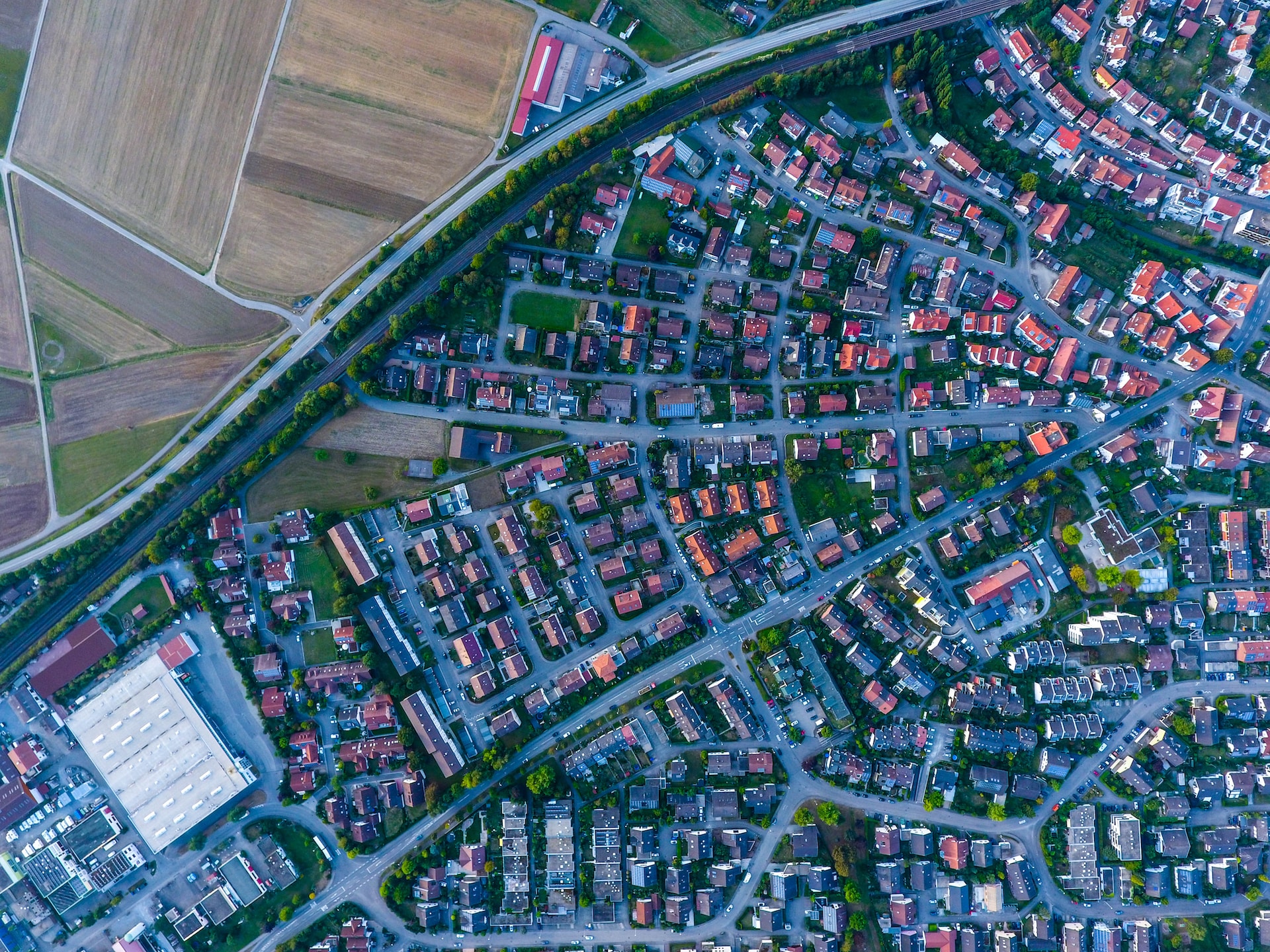

Discover investment worth of your existing or prospective tangible real estate asset to relate with your risk-return profile or risk appetite.

Determine Value

via Investment Appraisal

Investment appraisals aid investors in the investment decision-making process by providing an independent / unbiased / conversant estimate of the asset in the open market. Essential bases of value that investors commonly review are quoted below and defined by the International Valuation Standards Council (IVSC):

“Investment Value/Worth is the value of an asset to a particular owner or prospective owner for individual investment or operational objectives.”

“Market Value is the estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion.”

Market value basis prevails in real estate appraisal since it considers highest and best use in a market comprising of abundant buyers and sellers; whereas, investment value conception is linked to the benefits of holding the asset without the necessity of exchange.

Investors should recognize that appraisal with market value as the basis only pertains to the price of the asset and not whether it is under- or over-priced; hence, it does not ascertain what the asset may actually be worth to an investor. Investment value measures investment performance and would indicate worth only to a specific investor due to variation in risk appetite, portfolio structure, tax implications and expected cash flows.

Investors wisely embark on opportunities where the investment value exceeds the asking price by representing a positive net present value suitable for their prospects inclusive of evaluating the projected returns with the aforementioned risk-return profile.