Our services

Identify demand and benefit for applicable potential land use

Determine potential profitability, sensitivity and risks pertaining to land acquisition for potential uses through pro forma and feasibility studies.

Maximize Profit

Develop a Feasibility Study

Investors willing to undertake heightened risks through acquisition of land are privileged to perform permitted real estate development activities for commercial, residential or mixed end-use. Due to various complex risks associated with such investment, the investor assesses the development potential in terms of absolute development costs, residual land value and expected profitability prior to undertaking any development schemes.

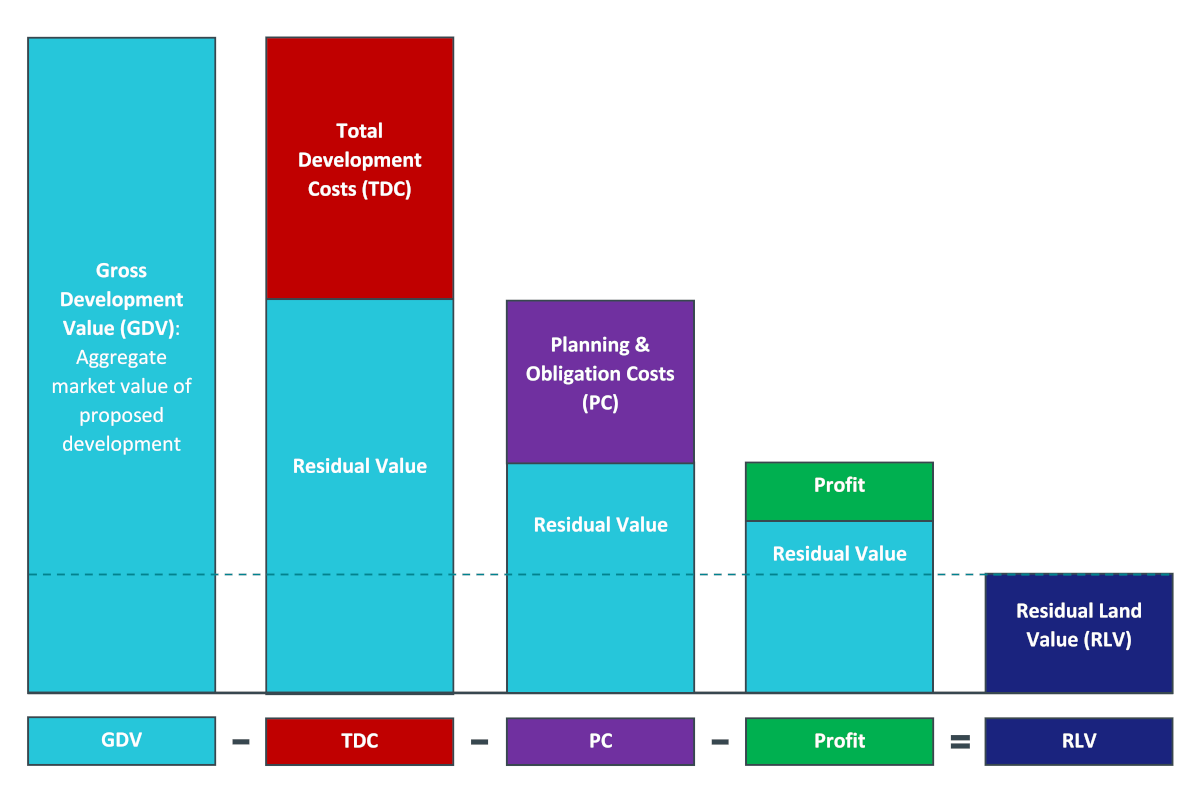

Various techniques exist to undertake pro forma and feasibility studies of real estate investment and development opportunities; prevalent method of determining potential profit and residual land value are illustrated below.

©REALTYGY; Based on RICS Guidance Note.

From above, the development risk investors embark on in entirety constitutes of various anticipated elements forming TDC and PC that lead to completion or partial completion of the development. These risks exist throughout the life cycle of the development phase and extend towards the post-construction letting and sales stage. Investors are obliged to equip themselves with understanding of associated risks involved throughout the development process since potential profit should represent an appropriate proportion of the TDC.

TDC shall comprise of all the costs linked to land acquisition, construction activity, professional services (architecture + engineering), demolition of existing structure (if applicable), landscaping / internal circulation roads, mandatory developer contributions, marketing / promotion and applicable financing. Although uncontrollable external effects impact the actual TDC due to variations and uncertainty involved in each of these sub-activities, investors are provided with a sensitivity analysis showing 8-12% increase or decrease of initially estimated costs for concluding whether the potential profitability suits their investment prospects.

Build quality is another pivotal factor that severely impacts the final purchase price apart from timing and location since as the development progresses, attention gradually shifts towards cost, completion and delivery, thus compromising on quality. Substantial efforts with effective and efficient managerial skills are required to reduce risks prior to performing the feasibility study from commencing to completion of development as cash-flows in real estate developments are always exposed to immense intensity of uncertainty.