Risk Evaluation

Since the value of real estate varies over time, the resultant intermittent variation is a repercussion of the various risk factors associated to the investment. The general perception that higher risks guarantee higher returns also implies that probability of failure is significant.

Risks within and beyond investor’s control can be enumerated by specialists using well-established techniques for successful implementation of risk management strategies; however, perfect prediction of all associated risks is impractical since the assessment and management of anticipated risks are considerably more complex in the real estate context.

Irrespective of attempting to achieve perfection, essential risk factors that investors should consider while evaluating real estate investments are discussed in sub-sections below.

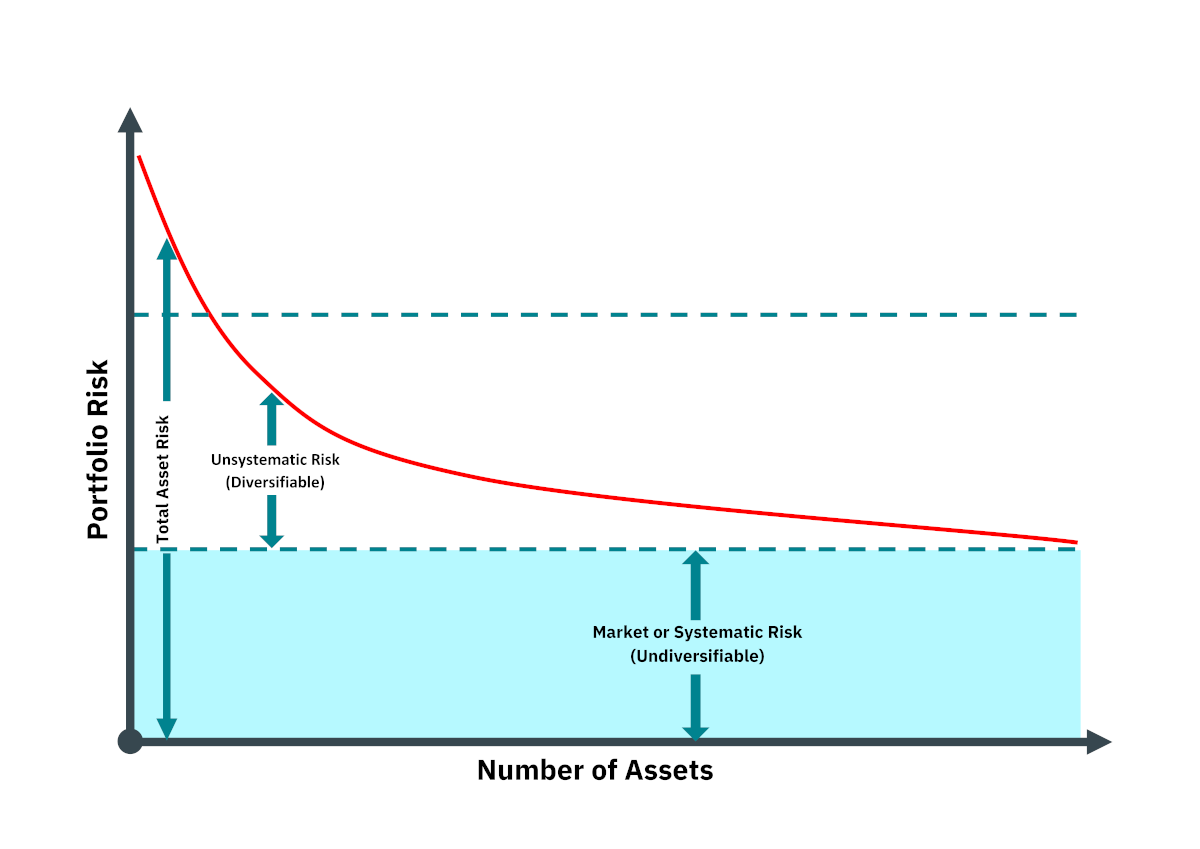

Market Risk

Investors predominantly encounter market (systematic or non-specific) risk which is complex to estimate due to its qualitative and quantitative nature. Diversification of such risks are not probable as these are simulated by evolving political, economic, social and environmental factors that impact the return on all assets or securities to varying degrees. Technically, investment’s market risk is measured by the beta (β) ratio that is derived from the risk premium above the risk-free rate for the subject market.

Specific Risk

Since the value of real estate varies over time, the resultant intermittent variation is a repercussion of the various risk factors associated to the investment. The general perception that higher risks guarantee higher returns also implies that probability of failure is significant.

Risks within and beyond investor’s control can be enumerated by specialists using well-established techniques for successful implementation of risk management strategies; however, perfect prediction of all associated risks is impractical since the assessment and management of anticipated risks are considerably more complex in the real estate context.

Irrespective of attempting to achieve perfection, essential risk factors that investors should consider while evaluating real estate investments are discussed in sub-sections below.

Asset Risk

Since the characteristics of every real estate asset is unique, investors are to be aware of its impact in broader terms as these will affect the overall risk of their portfolio. An evaluation of how asset-level factors such as local market uncertainty, supply / demand rates, demographics and rental trends, add to the expected allocation risks prior to commencing investment are to be premediated since diversification in future is not instantaneous. Due to limitation on participating in short-term strategic asset allocation, accurate forecasting of medium to long-term performance trends are to be analyzed.

Operational Risk

Since the characteristics of every real estate asset is unique, investors are to be aware of its impact in broader terms as these will affect the overall risk of their portfolio. An evaluation of how asset-level factors such as local market uncertainty, supply / demand rates, demographics and rental trends, add to the expected allocation risks prior to commencing investment are to be premediated since diversification in future is not instantaneous. Due to limitation on participating in short-term strategic asset allocation, accurate forecasting of medium to long-term performance trends are to be analyzed.

Liquidity Risk

The indivisible and illiquid nature of real estate makes investors conceivably more conservative and inclined towards medium to long-term outlook and compatible strategic asset allocation decisions. Investors expect recovery of principal by disposal at the end of holding period; however, attaining the appropriate exit value through legitimate means requires a strategy of its own since liquidating assets of high value are challenging and complex.