Our services

Minimize risk through proper

due diligence

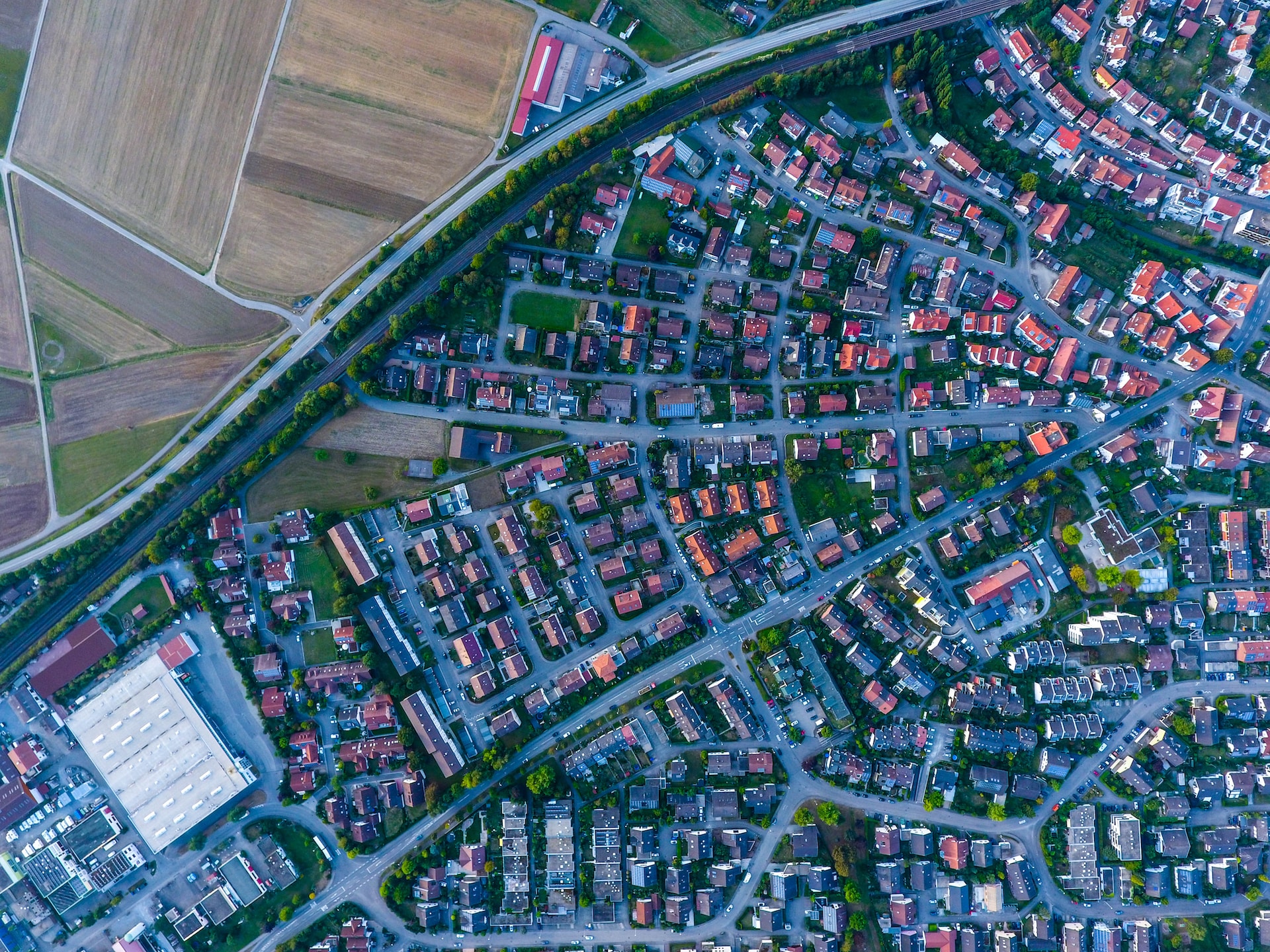

Understand the aspects associated to the property before binding yourself to consequent events.

Ascertain Details

Perform Due Diligence

Real estate due diligence plays a crucial part prior to acquisition, leasing, management and disposal as it fundamentally infers verifying the accuracy of details pertaining to the asset. Investors are provided with quantitative and qualitative facts about the asset in order to determine the associated risks, subsequent obligations and enveloping constraints before proceeding with the subject investment or executing an investment decision.

Essentially, due diligence is usually extensive and involves comprehensive assessment of both internal and external factors for explicating.

Common types of due diligence related to real estate are defined below:

- Administrative – Confirmation of ownership and control.

- Cadastral – Examination of cadastral regularity.

- Structural – Verification of existing structural conditions, statistics and safety.

- Construction – Compliance check with construction regulations, master plans and planning frameworks.

- Installation – HVAC and electrical checks for compliance with local regulations and international standards.

- Security – Verification of aspects related to national and international safety and security regulations.

- Environment – Conformity of indoor and outdoor environment for compliance.

For some of the above compliance, physical site visits may be required in order to validate the details; nevertheless, initial review of relevant records and details are required in order to determine the necessity.